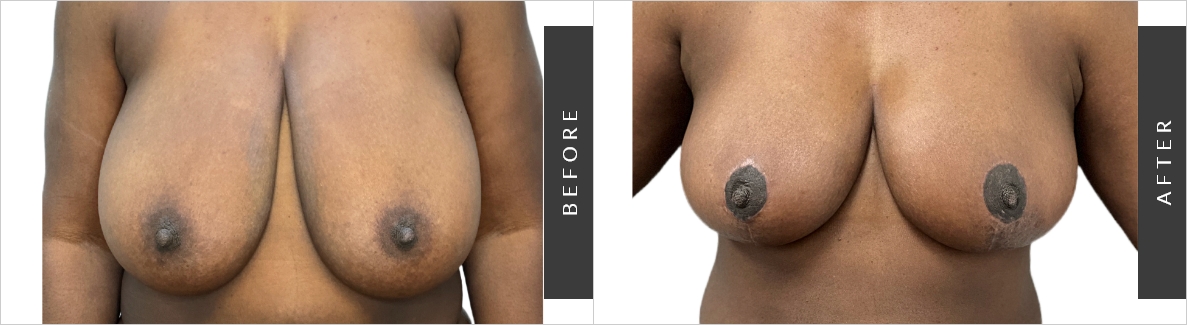

Breast Reduction Before & After Results

*results may vary

Will Insurance Cover Breast Reduction?

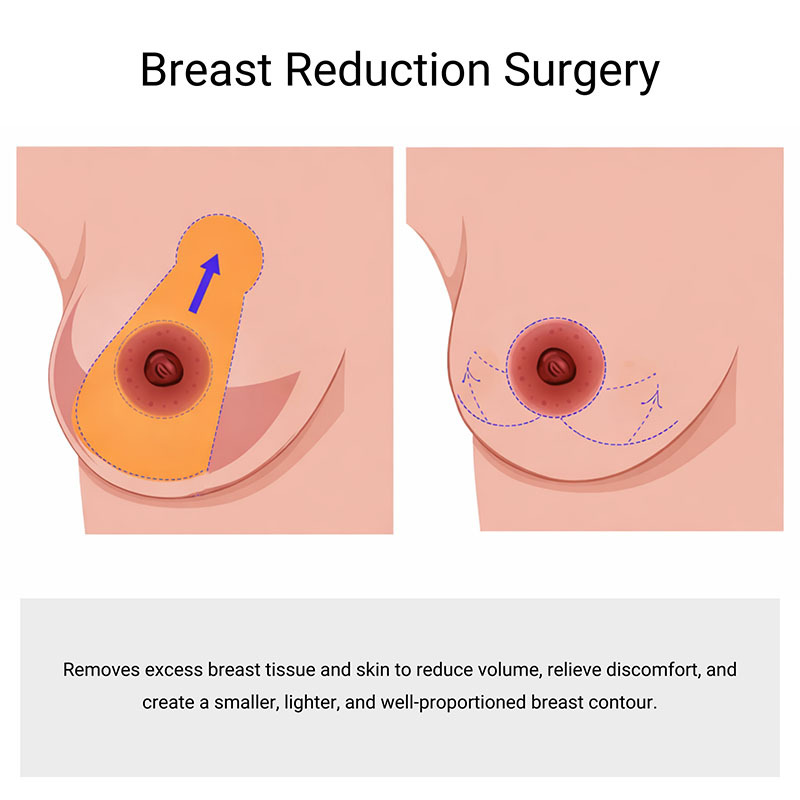

Health insurance may cover breast reduction, also referred to as mammoplasty, if the surgery is considered medically necessary. Some women are concerned about breasts that they feel are too small, so they seek options for breast augmentation. It’s difficult for large-breasted women to relate to those issues, since they suffer the opposite problem. When you’re experiencing issues like chronic back and neck pain related to the size of your breasts, it’s time to consider a mammoplasty.

There are certain criteria for how to get a breast reduction covered by insurance. You must meet these criteria, since most insurance policies won’t cover breast reduction for cosmetic reasons. If you’re wondering how to get a breast reduction covered by insurance, the best thing to do is make an appointment with an experienced breast reduction surgeon who takes insurance and understands breast reduction insurance requirements. In New York City, there’s no better choice than Dr. David Shokrian at Millennial Plastic Surgery.

When Is a Breast Reduction Covered by Insurance?

Most women exploring the question will insurance cover breast reduction suffer from a host of physical problems that are the result of having very large breasts. It’s incumbent on you to clearly document the medical necessity for insurance to cover this type of surgery. Women seeking breast reduction must be at least 18 years old with completed breast growth.

Medical issues caused by very large breasts include:

- Neck, shoulder or back pain. The strain of supporting large breast weight can cause chronic pain in your back, neck or shoulders, which then affects your daily activities and reduces your quality of life.

- Headache and fatigue. Women with excessively large breasts often experience headaches and fatigue from supporting their weight.

- Poor posture. Women with very large breasts often have difficulty with posture or with standing up straight, which can lead to skeletal deformities over time.

- Shoulder grooves. Large breasts continually tug on bra straps, causing painful grooving and sometimes ulceration in your shoulders.

- Skin inflammation. Heavy breasts trap excess moisture underneath them, triggering frequent irritation, rashes or skin infections.

- Nerve pain or numbness. Excess breast weight can compress nerves. This causes tingling, numbness or pain in your upper extremities. Compressed nerves can also lead to reduced sensation in your nipples.

- Restricted physical activity. Discomfort and pain often trigger limitations in daily activities or in sports or exercise participation.

- Breathing problems. When your chest is compressed, it can affect respiratory functioning, leading to difficulty breathing normally.

- Emotional distress. Women and adolescents with abnormally big boobs often have difficulty finding clothes that fit, causing them to experience self-consciousness, low self-esteem and poor body image.

Surgery for breast reduction to produce a symmetrical appearance after a mastectomy or lumpectomy is also considered a medical necessity. Excessively large breasts that are disproportionate to your body frame is known as macromastia. Breasts that contain more than five pounds of breast tissue are considered gigantomastia, which is a rare condition.

56 West 45th Street, 4th floor

56 West 45th Street, 4th floor New York, NY 10036 3190 Riverdale Ave. Level C #4A

Bronx, NY 10463 1000 Northern Blvd Suite 165

Great Neck, NY 11020

Does Insurance Cover Breast Reduction with Proper Documentation?

If you ask your cosmetic surgeon — “Is breast reduction covered by insurance?” — you learn that thorough documentation is necessary to get coverage. Every health insurance plan has its own requirements, so your first step should be to contact your insurance carrier to find out about your specific coverage and whether you need pre-authorization.

A breast reduction surgeon who takes insurance and their experienced staff are familiar with documentation that demonstrates medical necessity, such as:

- Visits seeking medical care. Records from your doctor documenting office visits when you sought treatment for chronic pain, rashes or activity limits relating to breast size, along with physician’s notes, demonstrate medical necessity.

- Non-surgical treatments. Insurance companies may require proof that you tried alternative forms of treatment without relief of your discomfort, such as topical treatments, special supportive bras, bras with wide straps, physical therapy or weight loss.

- Measurements and photos. Documentation of your breast size and the amount of tissue to be removed is usually required. The Schnur sliding scale chart is a method for evaluating body surface area and the average weight of the breast tissue to be removed, which can provide proof of medical necessity. Your surgeon may need to indicate that there’s a reasonable prognosis of symptom relief after breast reduction surgery.

Some insurance companies require documentation that symptoms relating to large breasts have been impacting your life for at least three to six months. Besides records of medical visits, it may be helpful for you to document your own symptoms over time by keeping a log that records details such as pain levels, activities that you missed and episodes of rashes or infections.

How Much Is a Breast Reduction with Insurance and without Insurance?

The cost of a breast reduction with insurance varies widely, based on your individual insurance policy, which includes your deductible and out-of-pocket costs. If your NYC plastic surgeon has documented medical necessity, your health insurance company pays based on your benefits, but you’re responsible for your portion of the total charges.

The cost of a breast reduction with insurance varies widely, based on your individual insurance policy, which includes your deductible and out-of-pocket costs. If your NYC plastic surgeon has documented medical necessity, your health insurance company pays based on your benefits, but you’re responsible for your portion of the total charges.

Factors that affect the amount you pay include:

- Deductible. Your deductible is the amount you pay for your health care before the insurance company begins to pay. If you have a high-deductible insurance policy, you may have to pay a large amount out-of-pocket before insurance coverage kicks in.

- Co-insurance or co-pay. You may have to pay a co-pay for surgery and other healthcare services. Your health insurance states the amount they pay for surgery, for example, they may cover 80 percent of the cost while you’re responsible for 20 percent of the cost.

- Provider. Costs also vary based on your location and the experience of your surgeon. With some insurance policies, your cost may be lower if you choose breast reduction surgeons who accept insurance and are in your network.

With no health insurance coverage, the cost of a breast reduction typically ranges from $7,000 to $19,000, which includes a variety of expenses, such as the surgeon’s fee, facility fees and anesthesia. If you have health insurance and your surgery has been deemed medically necessary, your out-of-pocket cost may range from approximately $850 to $4,000, depending on your coverage and deductible. Financing options are available at Millennial Plastic Surgery.

Why Choose Breast Reduction Surgeons Who Accept Insurance in New York City?

Finding relief from persistent pain is best when it’s resolved with experienced surgeons who understand your issues. When you’re looking for skilled Manhattan plastic surgeons with a reputation for delivering excellent results, there’s no better choice than Dr. Shokrian and his talented team of experts.

Some things that set Millennial Plastic Surgery apart from other practices include:

- Their dedicated and compassionate team

- A patient-focused approach that prioritizes your safety and reduces the risk of complications

- Their commitment to delivering the best possible results from every surgery, such as natural-looking results and minimal scarring

- Their use of the most advanced techniques

Breasts play a significant role in how you feel about yourself — and bigger isn’t always better. If enormous breasts are reducing your quality of life, contact the team at Millennial Plastic Surgery. They work with your insurance company to find out exactly how to get a breast reduction covered by insurance. Comprehensive consultations are available both in person and online. Schedule your consultation today.